I always said I would never open a credit card…

In 2014, I started my time at USAFA and still held to the Ramseyan no-credit-cards rule I had set for myself when I was in high school. I left the academy in 2015 to serve a mission for my church in Santiago, Chile, and returned to USAFA in 2017. At that point, I had several friends with the Amex Platinum card and they basically fought each other over who was going to give me their referral link.

Naively, I applied for the Amex Platinum with no credit history or understanding of what the card even was. All I knew was that it had some expensive annual fee and I would get it waived for being in the military. In their zeal to get the referral points, my friends somehow managed to forget to mention that the Amex Platinum was a premium travel credit card and would require an excellent credit score to get approved. So, not only did I get denied when I first applied, but my friends encouraged me to apply a second time a month later. And I applied. And I got denied. Thanks, guys.

Jacob to the rescue🦸🏼♂️

My good friend, Jacob, finally stepped in and explained I needed to open a low-end, no annual fee cashback credit card to get some credit history and then I could apply for the Platinum. I applied for the USAA Cashback card by American Express and began my habit-building journey.

I didn’t grow up with very good money habits. My parents taught me to go out and make money, so I spent a lot of time knocking on doors expanding my recycling and yard work businesses. However, I was never very good at saving my money. In fact, I earned thousands of dollars in high school, and by the time I graduated I had nothing to show for it but a couple longboards and a skimboard.

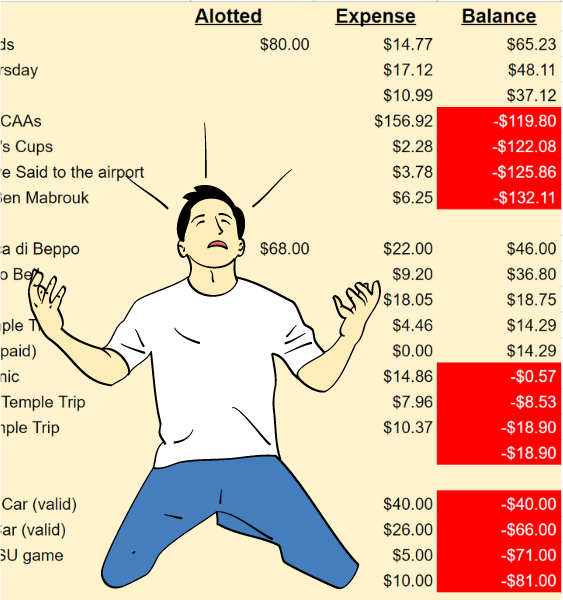

This new USAA Cashback card was an opportunity to practice tracking my expenses and get my money habits under control. The card also had a $1,000 limit, which meant that even if it took me a while to figure things out, I couldn’t dig myself that big of a hole.

I busted out the spreadsheets and began tracking my expenses. For months, my meager stipend would last me 3 weeks and then I’d put the last week’s expenses on my card. My paycheck would hit at the end of the month, I’d pay off the card, and the cycle would begin again. It took me about 12 months before I was no longer living on the credit card float. Once I had a few months of no red behind me, I decided I was ready for the big kid credit cards. Although, I still had absolutely no idea what the Amex Platinum would do for me. Which is probably why it took me another two years before I actually opened it…

The Intersection of Financial Independence & Travel Hacking💸✈️

In 2019, my brother introduced me to ChooseFI, a podcast that talks about two things: pursuing financial independence and travel hacking. To say I was hooked would be an understatement. I. Was. Obsessed. For the next 8 months I listened to 1,200 hours of personal finance, FI, and travel hacking podcasts. And for the first time in years, I read a book of my own accord.😲

As I was preparing to graduate USAFA in 2020, I realized I was going to have some big purchases coming up. My academy computer was a steaming pile of garbage, and there was going to be a good number of moving expenses coming up with the PCS, so I decided to open my first big boy credit card — the Chase Sapphire Reserve. I hit the minimum spend of $4,000 in 3 months and got my sign up bonus of 50,000 points. Since that day, I’ve been hooked.

Where we are today🔆

After I left the Zoo, I got married to my beautiful wife and we have since opened 32 cards, earned millions of points and miles, redeemed millions of points and miles, had a couple babies, and dragged those babies all over the world using credit card rewards to pay for just about everything.

We currently get $11,656 of annual fees waived every year because I’m active duty!

We’ve used travel rewards to go on ultra-luxury vacations in Greece, get cheap hotels for our honeymoon road trip (we PCS’d from Colorado to California 2 days after our wedding), road tripped all over Europe, and get flights to visit family in Hawaii, Baltimore, Utah, Colorado, Texas, and California. We’ve flown family members from all over the US to Europe and stayed everywhere from dumpy side-of-the-road budget hotels to 5-star hotels all on points, and we’re just getting started…

We’ve been stationed in Italy for a few years and plan to take travel hacking to the next level over the next decade. This website is designed to be a place where I can document everything we learn and share that knowledge with other military families.

Thanks for joining us on this journey! Send us a message if you want to meet up for gelato 🙂

Cheers!

Jared “Tusi”, Marisha, Talitha, and Sirsha

If you ever want to talk about credit cards, points and miles, financial independence, being in the military, or if you just want to meet up for some gelato, shoot me a message! I love meeting new people and an excuse to get gelato🍨